Get upto 4%* on our Savings Account Balances with Globalinter Cash Service.

More DetailsLooking

Looking

Get upto 4%* on our Savings Account Balances with Globalinter Cash Service.

More DetailsDear Customer, We have launched Video KYC facility for New customer to open savings ac

Globalinter Cash Service has developed an instrument for that growth, one that creates transparency: the Streling Rise Footprint. This visionary investment compass gives investors insight, foresight and a sense of security. We are driving the paradigm change The financial industry is on the verge of a paradigm change and Globalinter Cash Service is proactively shaping that transition. It is the pioneer of a new culture and total transparency in banking. While other commercial sectors – the book trade, music industry and media world, to name just a few – have undergone dramatic fundamental change and developed further, the banking industry in many places is still functioning the same way it did twenty years ago. Innovative companies such as Amazon and Apple have long focused resolutely on customer benefit. The financial industry, however, has gone in the opposite direction. It has decoupled from the real economy: back in the 1980s, the cumulative assets of all banks in the world roughly equalled the global gross national product – today, those assets are five times as large.

Some businesses are inherently more profitable than others. This can be due to expenses and overhead being low or the business charging a lot for its services or products. Still, all businesses, no matter how profitable they are, can be a challenge getting started. If you are thinking of starting a small business, you might care about potential profits. While your skills as an entrepreneur and the quality of your business idea certainly influence what you will earn, so does the industry in which you operate. In fact, as figures from business data aggregator show small business profitability varies a lot across industries.

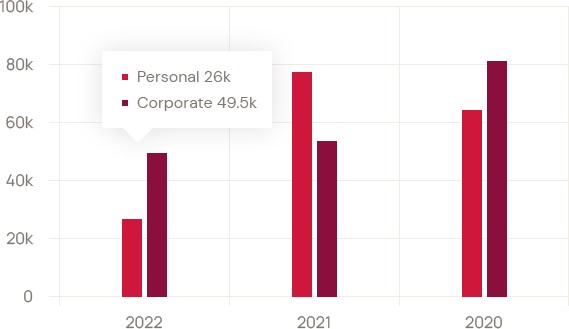

Numbers that speak About Globalinter Cash Serviceing service.

86 Branches around the country

More than 1.5 illion customers

1.6k professional employees

45.6 Cr loans for 258 customers

Outstanding performance and achievements.